Fraud Detection

Reduce fraud and accept more transactions. Fraudsters use emerging technology to advance their fraud schemes, causing serious damage to your borrowers and lenders. We help our customers to stay on top of emerging fraud trends and offer better protection. We combine institution-level risk thresholds with behavioural logic that identifies individual and peer deviations with typology pattern recognition to stop fraudsters in their tracks.

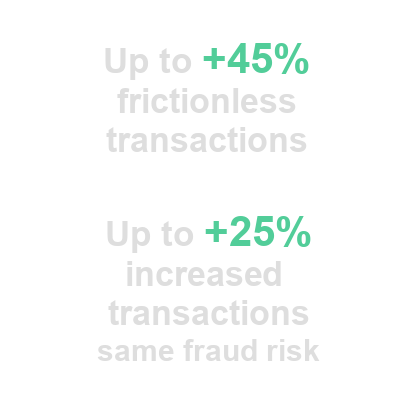

We help our customers to turn fraud detection into an advantage, managing fraud and boosting transactions with the accuracy of machine learning

Organisations must balance reaching their digital ambition with the need to combat increasingly more technologically adept criminals.

Identify legitimate transactions and makes it easier to complete them. Partner with us to lift revenue, improve customer experience, and drive loyalty.

Our scalable solution adapts to meet your evolving needs as you enter markets, launch new products, and offer omnichannel fulfillment flows.

Risk Based Authentication Scoring

Risk scores are the key measure for RBA and are used to determine risk level. Our technology protects against sophisticated security breaches and hackers, while reducing issues that result from a dependence on passwords and one-size-fits-all authentication strategies. Our scoring improves fraud detection and enhances ease of use.

Risk Based Authentication Insights

With our RBA, data is acquired and aggregated in the context of the established risk acceptance criteria. Analysis of the data is performed using proprietary decision analytics, and through a fully flexible process, high risk profiles result in stronger challenges, and transparently request additional credentials when risk level is higher.

Fraud Scoring

We improve fraud detection with analytical models specifically designed to handle the behavioural profiling challenges of financial and non-financial transactions. Our enterprise Fraud Prevention Solution encompasses all customer- and product-related risks and creates adequate business- and customer-related security systems.

Fraud Insights

Risk scores are the key measure for RBA and are used to determine risk level. Our technology protects against sophisticated security breaches and hackers, while reducing issues that result from a dependence on passwords and one-size-fits-all authentication strategies. Our scoring improves fraud detection and enhances ease of use.